Webinar: How to Build Your Beauty Brand With Product Reviews and Social Content

How deeply do beauty influencers actually shape consumer attitudes? This week, Tribe Dynamics co-founder and president Conor...

August 20, 2019

Anyone in the online beauty world knows that it’s a fast-paced game: buzz around new brand and product launches can fade as quickly as the latest influencer drama. So, how can you make a lasting impression? Using consumer review data from Influenster, along with proprietary earned media value (EMV) data and influencer community metrics, Tribe Dynamics identified key strategies for brands to drive growth at any stage in their life cycle.

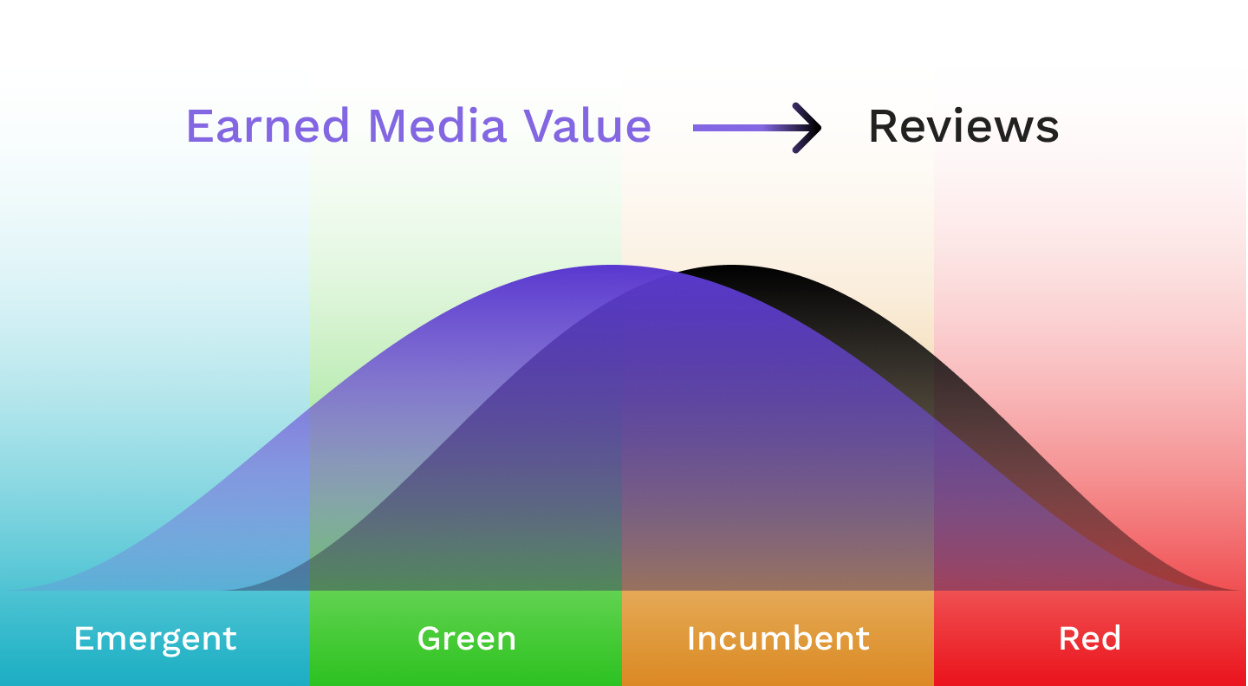

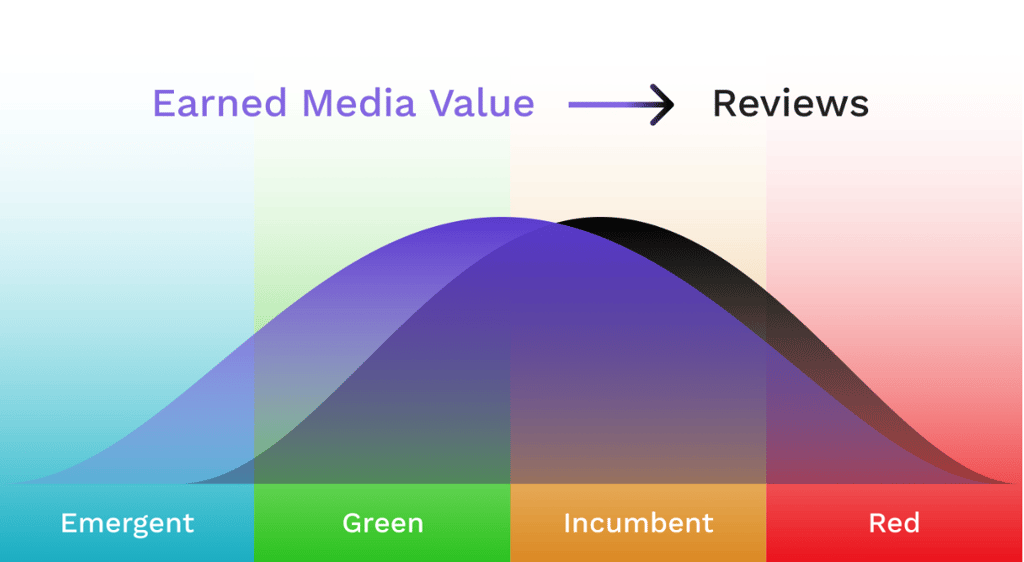

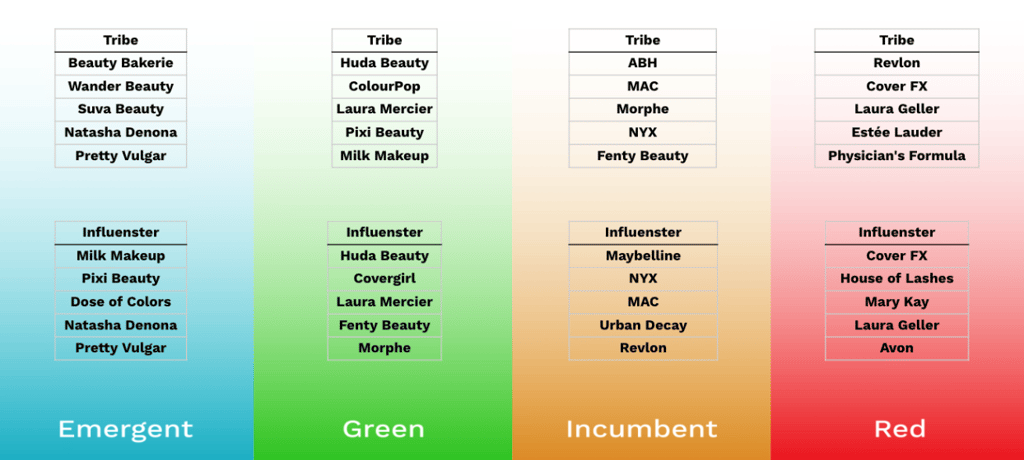

You can probably name a brand that’s all over the Internet, but no one seems to buy. To understand the relationship between influencer excitement and consumer engagement, we compared the EMV performance of numerous brands—along with the size, impactfulness, and posting habits of their influencer communities—from the past year to volume and growth in consumer reviews. Using both data sets, we broke brands into four categories, representing stages in a brand’s life cycle:

We found significant correlations between Tribe Dynamics and Influenster data: when influencers are talking about a brand, consumers are more likely to review it. In many cases, however, influencer conversations preceded consumer reviews: brands that fell into the “emergent” category based on consumer review data were already “green” by Tribe Dynamics metrics, and brands that were “green” based on consumer review data were “incumbent” with regard to influencer content. This suggests that influencer excitement about a brand drives consumers to buy and review a product—which, in turn, validates influencer opinions.

“Emergent” brands are brands that have just been discovered—and need to build clout. In every vertical, brands with a low, but fast-growing, volume of reviews saw the highest year-over-year EMV growth figures of brands in any category, with “emergent” cosmetics brands posting a 32% YoY EMV increase. This growth extended across metrics: influencer community size, number of posts, and average EMV per content creator also surged ahead. Notably, cosmetics brands that fell into the emergent category by volume of influencer content (rather than review volume) enjoyed even more impressive gains, averaging a 174% YoY EMV improvement.

This high-growth state is exciting—but if “emergent” brands start to slip, they’re one step away from going “red.” To maintain momentum, these rising contenders should prioritize community expansion by identifying potential brand champions and engaging them through personalized product sends, invitations to events, and other gestures of appreciation.

Annual Growth in EMV and Community Metrics for "Emergent" Brands by Vertical

(July 2018 - June 2019)

| Vertical | EMV YoY Change | EMV Per Influencer YoY Change | # of Influencers YoY Change | # Influencer Posts YoY Change | Posts Per Influencers YoY Change |

| Cosmetics (Reviews) | 32% | 20% | 5% | 18% | 7% |

| Cosmetics (Influencer Content) | 174% | 54% | 57% | 111% | 27% |

| Haircare (Reviews) | 25% | 26% | 1% | 7% | 6% |

| Haircare (Influencer Content) | 125% | 67% | 26% | 70% | 37% |

| Skincare (Reviews) | 34% | 40% | -5% | -1% | 0% |

| Skincare (Influencer Content) | 114% | 55% | 38% | 72% | 23% |

Brands in the “green” are popular, but still have room for growth. Members of this set—which includes Laura Mercier, Revolution Beauty, and Huda Beauty—have built a reputation, but are still inspiring excitement from new fans. In our analysis, brands that ranked “green” by review volume consistently grew YoY in EMV and EMV per ambassador, but saw slight declines in community size. Brands that were “green” by influencer content volume grew by all three metrics, but saw only slight increases in community size (for example, cosmetics brands expanded their communities just 8%, on average, relative to their 52% increase in EMV per ambassador).

Although “green” brands have achieved prominence, they face a new challenge: community growth becomes more challenging at scale. For this reason, these brands need to prioritize retention by consistently re-energizing their core supporters, while still embracing new advocates.

Annual Growth in EMV and Community Metrics for "Green" Brands by Vertical

(July 2018 - June 2019)

| Vertical | EMV YoY Change | EMV Per Influencer YoY Change | # of Influencers YoY Change | # Influencer Posts YoY Change | Posts Per Influencers YoY Change |

| Cosmetics (Reviews) | 21% | 34% | -10% | 1% | 12% |

| Cosmetics (Influencer Content) | 71% | 52% | 8% | 34% | 23% |

| Haircare (Reviews) | 11% | 40% | -20% | -12% | 10% |

| Haircare (Influencer Content) | 34% | 42% | -3% | 28% | 35% |

| Skincare (Reviews) | 11% | 29% | -17% | -14% | -2% |

| Skincare (Influencer Content) | 103% | 47% | 36% | 57% | 14% |

It’s lonely at the top. Brands with a high review volume, but low growth, are starting to peak—and they need to work to stay relevant. According to our analysis, brands in this set (by reviews) saw declines in EMV, community size, and post count, but increased EMV per ambassador. The same trends were reflected among brands who ranked “incumbent” by influencer content volume, suggesting that while these brands boast highly invested communities, they’re struggling to retain them.

Rather than resting on their laurels, “incumbent” brands like MAC, Maybelline, and NYX Professional Makeup can continue to drive enthusiasm by nurturing their relationships with loyal brand champions. This is also the time to take risks: innovative activations, unexpected product launches, and new influencer collaborations can help create novelty and reinvigorate excitement around well-known brands.

Annual Growth in EMV and Community Metrics for "Incumbent" Brands by Vertical

(July 2018 - June 2019)

| Vertical | EMV YoY Change | EMV Per Influencer YoY Change | # of Influencers YoY Change | # Influencer Posts YoY Change | Posts Per Influencers YoY Change |

| Cosmetics (Reviews) | -4% | 19% | -20% | -17% | 3% |

| Cosmetics (Influencer Content) | -8% | 13% | -19% | -19% | 0% |

| Haircare (Reviews) | -1% | 17% | -18% | -15% | 2% |

| Haircare (Influencer Content) | -2% | 29% | -22% | -19% | 6% |

| Skincare (Reviews) | 4% | 31% | -25% | -28% | -6% |

| Skincare (Influencer Content) | 1% | 26% | -21% | -27% | -8% |

Brands with relatively little content, and slow growth, might be playing to the wrong crowd. As expected, brands in this category (either by review volume or influencer content volume) declined, on average, across all community metrics excluding EMV per influencer, and generally saw steeper EMV declines than “incumbent” brands.

Many brands in this category are heritage brands with more mature, less social media-savvy consumer bases—so building an authentically engaged influencer community will take some extra work. Other brands might simply be activating the wrong ambassadors. If this is the case, brands can still work their way back to growth by overhauling their current outreach strategies and implementing new plans to garner organic support.

Annual Growth in EMV and Community Metrics for "Red" Brands by Vertical

(July 2018 - June 2019)

| Vertical | EMV YoY Change | EMV Per Influencer YoY Change | # of Influencers YoY Change | # Influencer Posts YoY Change | Posts Per Influencers YoY Change |

| Cosmetics (Reviews) | -14% | 12% | -23% | -26% | -4% |

| Cosmetics (Influencer Content) | -19% | 4% | -22% | -25% | -3% |

| Haircare (Reviews) | -3% | 18% | -16% | -18% | 1% |

| Haircare (Influencer Content) | -17% | 14% | -26% | -28% | -1% |

| Skincare (Reviews) | 17% | 41% | -20% | -19% | -1% |

| Skincare (Influencer Content) | 2% | 37% | -26% | -31% | -7% |

Wherever your brand lands in this life cycle, there are steps you can take to build a community of advocates who will help you sustain or reinvigorate growth. To learn more about the influencer marketing tactics that can help your brand succeed, read our recommendations on what makes a winning influencer marketing strategy.

How deeply do beauty influencers actually shape consumer attitudes? This week, Tribe Dynamics co-founder and president Conor...

As malls emptied out for months amid stay-at-home orders, the era of oversized shopping bags and ear-piercing kiosks may be over...

As more and more consumers educate themselves about the ingredients in their beauty products, the demand for cleaner beauty is...

Tribe Dynamics’ data-powered influencer marketing platform spotlight the most relevant activations, products, and brands that are driving earned media and moving the landscape (as we speak).

Tribe Dynamics provides iconic brands the full picture of their influencer marketing programs through industry-leading data and influencer marketing analytics solutions. We work with brands, retailers, and agencies across industries—from beauty to entertainment—so let’s get in touch to see if we’re the right fit for you!

“Working with Tribe Dynamics over the past 5+ years has been a true partnership in every sense of the word. The sophistication in their data is unmatched in the industry, and the level of insight in their analysis has become indispensable for any marketer in the beauty space today. They’re truly best-in-class.”

"Tribe Dynamics' influencer marketing platform provides a holistic view of our ambassadors as well as hard data that proves their importance to company leadership."

San Francisco

548 Market St, PMB 85210

San Francisco, CA 94104

Los Angeles

600 Corporate Pointe Ste 210

Culver City, CA 90230

London

WeWork c/o CreatorIQ

Aviation House

125 Kingsway

London, WC2B 6NH